Invoice creation

If you are struggling to create a new invoice with our API this is the place where you want to be, you will learn every step to successfully create your invoice from scratch.

We'll build the request step by step, so wait until the end of the guide to send your first request!

The main API method used in this guide will be the Create Issued Document method, but some of the steps will use other API methods to create or retrieve the needed resources.

You can find the required models on our API Reference section or on the documentation of the SDK you're using (check the GitHub repo or the Package Manager page).

If you want to download the complete SDKs examples you can find them here.

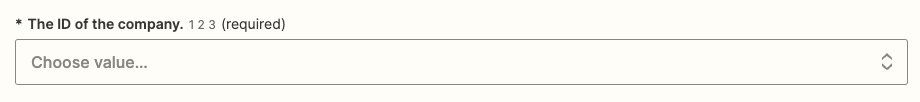

In this example, we'll suppose you have to manage just one Company, so we simply inserted its ID directly in the code. If instead, you need to be able to manage multiple companies, you'll need to retrieve the ID of the current company in some way.

Check the Company-scoped Methods page for more info.

Zapier Actions provide all the fields offered by the APIs, but it does not mean you need to compile all of them!

For example, while creating a new Issued Document the Document ID must be left blank!

To follow this guide, you will be required to search the fields used in our example on the Zapier page and insert the related values.

The code of the fields will follow the JSON structure: for example, the "type" field is included in the "data" object, so the Zapier code will be "data.type".

You can use the CRTL + F command to search the field's code faster 😉

In this example, we'll insert the values directly, but please remember that Zapier was built to let you select the workflow's previous steps' outputs as input in the Action, for example selecting the values returned by a trigger!

Unfortunately, no. Fatture in Cloud lets you send documents to the SDI only if they were created through the Fatture in Cloud functionalities, so if you have an XML you can't just send it to the SDI using our APIs.

Please, check this guide for a more detailed explanation.

ℹ️ Pre-Create Info

First of all, check out our Get Issued Document Pre-Create Info page, it contains most of the information you will need to create a new invoice.

0️⃣ Step Zero: The Document Type

In this guide, we will explain how to create an invoice. We choose this type of document because it is the most common, but keep in mind that the process is almost the same for every issued document.

The available types are:

- invoice: an invoice (we will use this type in this guide)

- quote: a quote

- proforma: a pro forma invoice

- receipt: a tax receipt

- delivery_note: a delivery note

- credit_note: a credit note

- order: an order

- work_report: a work report

- supplier_order: an order by the supplier

- self_own_invoice: a self-invoice in which the issuer of the document appears both as the customer and as the supplier

- self_supplier_invoice: a self-invoice in which the issuer of the document appears as the customer, while the other company acts as the supplier

1️⃣ Step One: The Customer

To create an invoice, we need the customer's details. You have three options:

-

If the customer's details were already inserted in Fatture in Cloud, you can retrieve it using our API and add it to the request. See also: Get the list of existing clients

-

If the client wasn't inserted in Fatture in Cloud, but it will likely be a recurring customer (so you would like to store his details), you can insert it now, and use the returned details to populate the request. See also: Client creation and the Create Client API

-

If the customer is most likely a one-time customer, you can just insert his details directly in the invoice.

The Client's data must be inserted in the entity field, as shown below. If you used the Clients API to store/retrieve the details, please remember to insert the entity.id field to link the invoice accordingly.

Our new Utilities tool also makes possible to export the current list of clients, so you could use it to jumpstart your invoice creation process!

If you choose to link an existing customer (or to create a new one) make sure you set all the fields you want to be shown in your invoice: at this moment we don't autocomplete your invoice with the customer details, even if he's already stored in Fatture in Cloud.

You can get the info about your client performing a Get Client request.

The partial request looks like this:

// NOTE: this is a partial request, please wait before sending it

{

"data": {

"type": "invoice",

"entity": {

"id": 1, // only if the client already exists

"name": "Mario Rossi",

"vat_number": "47803200154",

"tax_code": "RSSMRA91M20B967Q",

"address_street": "Via Italia, 66",

"address_postal_code": "20900",

"address_city": "Milano",

"address_province": "MI",

"address_extra": "",

"country": "Italia"

}

}

}

The corresponding code with our SDKs:

- C#

- Go

- Java

- JavaScript

- PHP

- Python

- Ruby

- TypeScript

- Zapier

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our C# SDK https://www.nuget.org/packages/It.FattureInCloud.Sdk/

// If you want to use our Client API:

// Retrieve a client: https://github.com/fattureincloud/fattureincloud-csharp-sdk/blob/master/docs/ClientsApi.md#listclients

// Create a new client: https://github.com/fattureincloud/fattureincloud-csharp-sdk/blob/master/docs/ClientsApi.md#createclient

// Insertion on-the-fly:

Entity entity = new Entity(

id: 1, // Only if the client already exists

name: "Mario Rossi",

vatNumber: "47803200154",

taxCode: "RSSMRA91M20B967Q",

addressStreet: "Via Italia, 66",

addressPostalCode: "20900",

addressCity: "Milano",

addressProvince: "MI",

country: "Italia"

);

IssuedDocument invoice = new IssuedDocument(

type: IssuedDocumentType.Invoice,

entity: entity

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Go SDK

// https://github.com/fattureincloud/fattureincloud-go-sdk

// If you want to use our Client API:

// Retrieve a client: https://github.com/fattureincloud/fattureincloud-go-sdk/blob/master/docs/ClientsApi.md#listclients

// Create a new client: https://github.com/fattureincloud/fattureincloud-go-sdk/blob/master/docs/ClientsApi.md#CreateClient

// Insertion on-the-fly:

entity := *fattureincloud.NewEntity().

SetId(1). // Only if the client already exists

SetName("Mario Rossi").

SetVatNumber("RSSMRA91M20B967Q").

SetTaxCode("RSSMRA91M20B967Q").

SetAddressStreet("Via Italia, 66").

SetAddressPostalCode("20900").

SetAddressCity("Milano").

SetAddressProvince("MI").

SetCountry("Italia")

// Now we create the invoice and link the entity

invoice := *fattureincloud.NewIssuedDocument().

SetEntity(entity).

SetType(fattureincloud.IssuedDocumentTypes.INVOICE)

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Java SDK https://search.maven.org/artifact/it.fattureincloud/fattureincloud-java-sdk

// If you want to use our Client API:

// Retrieve a client: https://github.com/fattureincloud/fattureincloud-java-sdk/blob/master/docs/ClientsApi.md#listlients

// Create a new client: https://github.com/fattureincloud/fattureincloud-java-sdk/blob/master/docs/ClientsApi.md#createclient

// Insertion on-the-fly:

Entity entity = new Entity()

.id(1) // Only if the client already exists

.name("Mario Rossi")

.vatNumber("47803200154")

.taxCode("RSSMRA91M20B967Q")

.addressStreet("Via Italia, 66")

.addressPostalCode("20900")

.addressCity("Milano")

.addressProvince("MI")

.country("Italy");

IssuedDocument invoice = new IssuedDocument()

.type(IssuedDocumentType.INVOICE)

.entity(entity);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our JS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-js-sdk

// If you want to use our Client API:

// Retrieve a client: https://github.com/fattureincloud/fattureincloud-js-sdk/blob/master/docs/ClientsApi.md#listClients

// Create a new client: https://github.com/fattureincloud/fattureincloud-js-sdk/blob/master/docs/ClientsApi.md#createClient

// Insertion on-the-fly:

let entity = new fattureInCloudSdk.Entity();

entity.id = 1; // Only if the client already exists

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

//now we instanciate the invoice and link the entity

let invoice = new fattureInCloudSdk.IssuedDocument();

invoice.type = new fattureInCloudSdk.IssuedDocumentType().invoice;

invoice.entity = entity;

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our PHP SDK

// https://packagist.org/packages/fattureincloud/fattureincloud-php-sdk

// If you want to use our Client API:

// Retrieve a client: https://github.com/fattureincloud/fattureincloud-php-sdk/blob/master/docs/Api/ClientsApi.md#listclients

// Create a new client: https://github.com/fattureincloud/fattureincloud-php-sdk/blob/master/docs/Api/ClientsApi.md#createclient

// Insertion on-the-fly:

$entity = new Entity;

$entity

->setId(1) // Only if the client already exists

->setName("Mario Rossi")

->setVatNumber("47803200154")

->setTaxCode("RSSMRA91M20B967Q")

->setAddressStreet("Via Italia, 66")

->setAddressPostalCode("20900")

->setAddressCity("Milano")

->setAddressProvince("MI")

->setCountry("Italia");

//now we instanciate the invoice and link the entity

$invoice = new IssuedDocument;

$invoice->setType(IssuedDocumentType::INVOICE);

$invoice->setEntity($entity);

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Python SDK

# https://pypi.org/project/fattureincloud-python-sdk/

# If you want to use our Client API:

# Retrieve a client: https://github.com/fattureincloud/fattureincloud-python-sdk/blob/master/docs/ClientsApi.md#list_clients

# Create a new client: https://github.com/fattureincloud/fattureincloud-python-sdk/blob/master/docs/ClientsApi.md#create_client

# Insertion on-the-fly:

entity = Entity(

id=1,

name="Mario Rossi",

vat_number="47803200154",

tax_code="RSSMRA91M20B967Q",

address_street="Via Italia, 66",

address_postal_code="20900",

address_city="Milano",

address_province="MI",

country="Italia"

)

invoice = IssuedDocument(

type = IssuedDocumentType("invoice"),

entity = entity

)

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Ruby SDK

# https://rubygems.org/gems/fattureincloud_ruby_sdk

# If you want to use our Client API:

# Retrieve a client: https://github.com/fattureincloud/fattureincloud-ruby-sdk/blob/master/docs/ClientsApi.md#list_clients

# Create a new client: https://github.com/fattureincloud/fattureincloud-ruby-sdk/blob/master/docs/ClientsApi.md#create_client

# Insertion on-the-fly:

entity = FattureInCloud_Ruby_Sdk::Entity.new(

id: 1,

name: "Mario Rossi",

vat_number: "47803200154",

tax_code: "RSSMRA91M20B967Q",

address_street: "Via Italia, 66",

address_postal_code: "20900",

address_city: "Milano",

address_province: "MI",

country: "Italia"

)

invoice = FattureInCloud_Ruby_Sdk::IssuedDocument.new(

type: FattureInCloud_Ruby_Sdk::IssuedDocumentType::INVOICE,

entity: entity

)

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our TS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-ts-sdk

// If you want to use our Client API:

// Retrieve a client: https://github.com/fattureincloud/fattureincloud-ts-sdk/blob/master/docs/ClientsApi.md#listClients

// Create a new client: https://github.com/fattureincloud/fattureincloud-ts-sdk/blob/master/docs/ClientsApi.md#createClient

// Insertion on-the-fly:

let entity: Entity = {};

entity.id = 1; // Only if the client already exists

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

//now we create the invoice and link the entity

let invoice: IssuedDocument = {

type: IssuedDocumentType.Invoice,

entity: entity,

};

In Zapier, first, you need to select your Company ID. Luckily, our Actions let you select it from a simple dropdown menu.

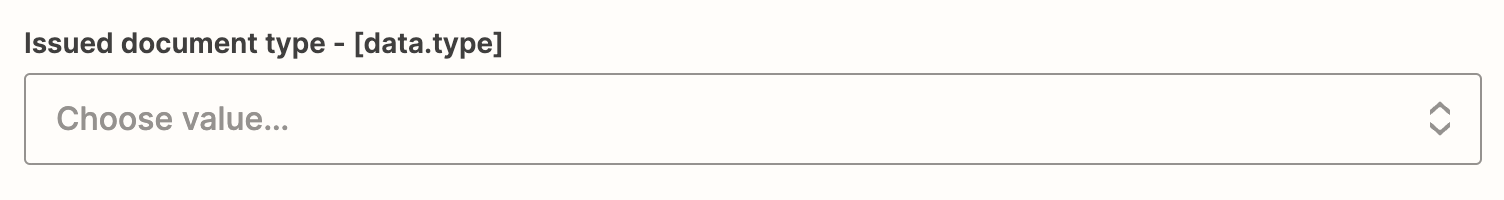

Next, you must set the Document Type we described in the previous step, you just need to select the correct value in the available list.

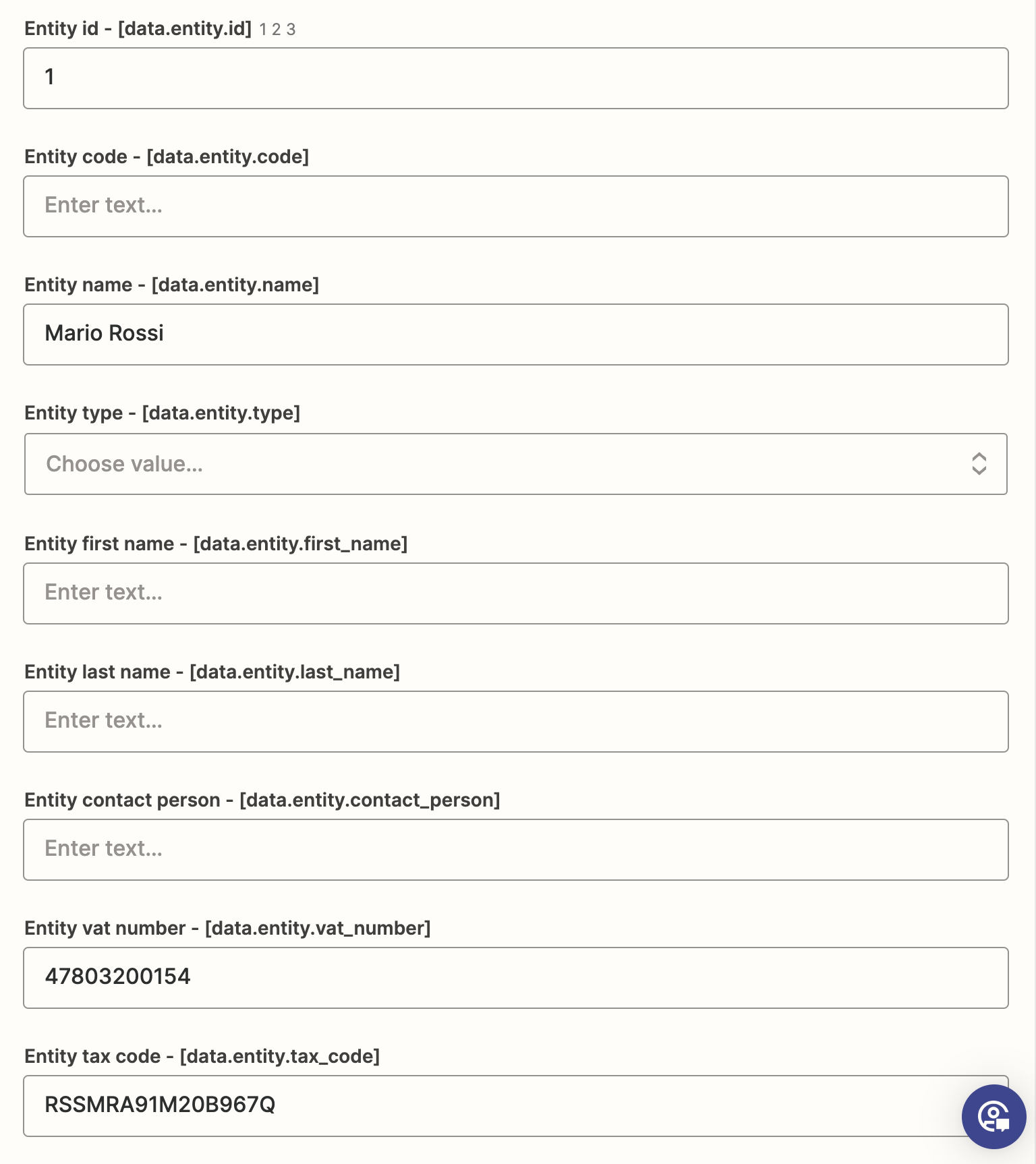

Then you must set up the entity as explained above. The entity fields' codes start with the "data.entity" prefix.

Remember: in this example, you must insert values only in the fields we are suggesting to you!

In the image below we can't show all the fields you must fill, so you must search them all as shown before.

Here you can find the list of all the fields and values you must fill for this example:

Here you can find the list of all the fields and values you must fill for this example:

| Field Name | Field Code | Value | Notes |

|---|---|---|---|

| Entity id | data.entity.id | 1 | It must be the ID of an existing Client, or blank. |

| Entity name | data.entity.name | Mario Rossi | |

| Entity vat number | data.entity.vat_number | 47803200154 | |

| Entity tax code | data.entity.tax_code | RSSMRA91M20B967Q | |

| Entity address street | data.entity.address_street | Via Italia, 66 | |

| Entity address postal code | data.entity.address_postal_code | 20900 | |

| Entity address city | data.entity.address_city | Milano | |

| Entity address province | data.entity.address_province | MI | |

| Entity country | data.entity.country | Italia |

2️⃣ Step Two: The Invoice Data

This section allows the insertion of your invoice's basic data, below you can find the main fields:

-

date: the date of issue.

-

number: the progressive invoice number, if omitted it gets automatically set ('numero documento', eg. 107).

-

numeration: optional invoice numeration ('sezionale documento', eg. "/FPA").

-

visible_subject: short optional invoice description (visible in the invoice PDF).

-

subject: short optional invoice description (not visible in the invoice PDF).

-

language: the document language, see: List Languages

-

currency: the currency used for the invoice payment, see: List Currencies

-

rc_center: optional field that represents the category of the generated revenue (centro di ricavo).

The partial request looks like this:

// NOTE: this is a partial request, please wait before sending it

{

"data": {

"type": "invoice",

"entity": {

"id": 1,

"name": "Mario Rossi",

"vat_number": "47803200154",

"tax_code": "RSSMRA91M20B967Q",

"address_street": "Via Italia, 66",

"address_postal_code": "20900",

"address_city": "Milano",

"address_province": "MI",

"address_extra": "",

"country": "Italia"

},

"date": "2022-01-20",

"number": 1,

"numeration": "/fatt",

"subject": "internal subject",

"visible_subject": "visible subject",

"currency": {

"id": "EUR",

"exchange_rate": "1.00000",

"symbol": "€"

},

"language": {

"code": "it",

"name": "Italiano"

}

}

}

The corresponding code with our SDKs:

- C#

- Go

- Java

- JavaScript

- PHP

- Python

- Ruby

- TypeScript

- Zapier

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our C# SDK

// https://www.nuget.org/packages/It.FattureInCloud.Sdk/

Entity entity = new Entity(

id: 1,

name: "Mario Rossi",

vatNumber: "47803200154",

taxCode: "RSSMRA91M20B967Q",

addressStreet: "Via Italia, 66",

addressPostalCode: "20900",

addressCity: "Milano",

addressProvince: "MI",

country: "Italia"

);

IssuedDocument invoice = new IssuedDocument(

type: IssuedDocumentType.Invoice,

entity: entity,

// Below you can find this section fields:

date: new DateTime(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visibleSubject: "visible subject",

// Retrieve the currencies: https://github.com/fattureincloud/fattureincloud-csharp-sdk/blob/master/docs/InfoApi.md#listCurrencies

currency: new Currency(

id: "EUR"

),

// Retrieve the languages: https://github.com/fattureincloud/fattureincloud-csharp-sdk/blob/master/docs/InfoApi.md#listLanguages

language: new Language(

code: "it",

name: "italiano"

)

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Go SDK

// https://github.com/fattureincloud/fattureincloud-go-sdk

entity := *fattureincloud.NewEntity().

SetId(1).

SetName("Mario Rossi").

SetVatNumber("RSSMRA91M20B967Q").

SetTaxCode("RSSMRA91M20B967Q").

SetAddressStreet("Via Italia, 66").

SetAddressPostalCode("20900").

SetAddressCity("Milano").

SetAddressProvince("MI").

SetCountry("Italia")

invoice := *fattureincloud.NewIssuedDocument().

SetEntity(entity).

SetType(fattureincloud.IssuedDocumentTypes.INVOICE).

SetDate("2022-01-20").

SetNumber(1).

SetNumeration("/fatt").

SetSubject("internal subject").

SetVisibleSubject("visible subject").

// Retrieve the currencies: https://github.com/fattureincloud/fattureincloud-go-sdk/blob/master/docs/InfoApi.md#listcurrencies

SetCurrency(*fattureincloud.NewCurrency().SetId("EUR")).

// Retrieve the languages: https://github.com/fattureincloud/fattureincloud-go-sdk/blob/master/docs/InfoApi.md#ListLanguages

SetLanguage(*fattureincloud.NewLanguage().SetCode("it").SetName("italiano"))

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Java SDK

// https://search.maven.org/artifact/it.fattureincloud/fattureincloud-java-sdk

Entity entity = new Entity()

.id(1)

.name("Mario Rossi")

.vatNumber("47803200154")

.taxCode("RSSMRA91M20B967Q")

.addressStreet("Via Italia, 66")

.addressPostalCode("20900")

.addressCity("Milano")

.addressProvince("MI")

.country("Italy");

IssuedDocument invoice = new IssuedDocument()

.type(IssuedDocumentType.INVOICE)

.entity(entity)

// Below you can find this section fields:

.date(LocalDate.of(2022, 1, 20))

.number(1)

.numeration("/fatt")

.subject("internal subject")

.visibleSubject("visible subject")

// Retrieve the currencies: https://github.com/fattureincloud/fattureincloud-java-sdk/blob/master/docs/InfoApi.md#listCurrencies

.currency(new Currency().id("EUR"))

// Retrieve the languages: https://github.com/fattureincloud/fattureincloud-csharp-sdk/blob/master/docs/InfoApi.md#listLanguages

.language(new Language()

.code("it")

.name("italiano")

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our JS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-js-sdk

let entity = new fattureInCloudSdk.Entity();

entity.id = 1;

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

let invoice = new fattureInCloudSdk.IssuedDocument();

invoice.type = new fattureInCloudSdk.IssuedDocumentType().invoice;

invoice.entity = entity;

// Below you can find this section fields:

invoice.date = "2022-01-20";

invoice.number = 1;

invoice.numeration = "/fatt";

invoice.subject = "internal subject";

invoice.visible_subject = "visible subject";

// Retrieve the currencies: https://github.com/fattureincloud/fattureincloud-php-sdk/blob/master/docs/Api/InfoApi.md#listcurrencies

invoice.currency = {

id: "EUR",

};

// Retrieve the languages: https://github.com/fattureincloud/fattureincloud-js-sdk/blob/master/docs/InfoApi.md#listLanguages

invoice.language = {

code: "it",

name: "Italiano",

};

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our PHP SDK

// https://packagist.org/packages/fattureincloud/fattureincloud-php-sdk

$entity = new Entity;

$entity

->setId(1)

->setName("Mario Rossi")

->setVatNumber("47803200154")

->setTaxCode("RSSMRA91M20B967Q")

->setAddressStreet("Via Italia, 66")

->setAddressPostalCode("20900")

->setAddressCity("Milano")

->setAddressProvince("MI")

->setCountry("Italia");

$invoice = new IssuedDocument;

$invoice->setType(IssuedDocumentType::INVOICE);

$invoice->setEntity($entity);

// Below you can find this section fields:

$invoice->setDate(new DateTime("2022-01-20"));

$invoice->setNumber(1);

$invoice->setNumeration("/fatt");

$invoice->setSubject("internal subject");

$invoice->setVisibleSubject("visible subject");

// Retrieve the currencies: https://github.com/fattureincloud/fattureincloud-php-sdk/blob/master/docs/Api/InfoApi.md#listcurrencies

$invoice->setCurrency(

new Currency(

array(

"id" => "EUR"

)

)

);

// Retrieve the languages: https://github.com/fattureincloud/fattureincloud-php-sdk/blob/master/docs/Api/InfoApi.md#listLanguages

$invoice->setLanguage(

new Language(

array(

"code" => "it",

"name" => "italiano"

)

)

);

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Python SDK

# https://pypi.org/project/fattureincloud-python-sdk/

entity = Entity(

id=1,

name="Mario Rossi",

vat_number="47803200154",

tax_code="RSSMRA91M20B967Q",

address_street="Via Italia, 66",

address_postal_code="20900",

address_city="Milano",

address_province="MI",

country="Italia"

)

invoice = IssuedDocument(

type = IssuedDocumentType("invoice"),

entity = entity,

# Below you can find this section fields:

date = datetime.date(2021, 1, 20),

number = 1,

numeration = "/fatt",

subject = "internal subject",

visible_subject = "visible subject",

# Retrieve the currencies: https://github.com/fattureincloud/fattureincloud-python-sdk/blob/master/docs/InfoApi.md#list_currencies

currency = Currency(

id="EUR"

),

# Retrieve the languages: https://github.com/fattureincloud/fattureincloud-python-sdk/blob/master/docs/InfoApi.md#list_languages

language = Language(

code="it",

name="italiano"

)

)

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Ruby SDK

# https://rubygems.org/gems/fattureincloud_ruby_sdk

entity = FattureInCloud_Ruby_Sdk::Entity.new(

id: 1,

name: "Mario Rossi",

vat_number: "47803200154",

tax_code: "RSSMRA91M20B967Q",

address_street: "Via Italia, 66",

address_postal_code: "20900",

address_city: "Milano",

address_province: "MI",

country: "Italia",

)

invoice = FattureInCloud_Ruby_Sdk::IssuedDocument.new(

type: FattureInCloud_Ruby_Sdk::IssuedDocumentType::INVOICE,

entity: entity,

# Below you can find this section fields:

date: Date.new(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visible_subject: "visible subject",

# Retrieve the currencies: https://github.com/fattureincloud/fattureincloud-ruby-sdk/blob/master/docs/InfoApi.md#list_currencies

currency: FattureInCloud_Ruby_Sdk::Currency.new(

id: "EUR"

),

# Retrieve the languages: https://github.com/fattureincloud/fattureincloud-ruby-sdk/blob/master/docs/InfoApi.md#list_languages

language: FattureInCloud_Ruby_Sdk::Language.new(

code: "it",

name: "italiano"

)

)

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our TS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-ts-sdk

let entity: Entity = {};

entity.id = 1;

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

let invoice: IssuedDocument = {

type: IssuedDocumentType.Invoice,

entity: entity,

date: "2022-01-20",

number: 1,

numeration: "/fatt",

subject: "internal subject",

visible_subject: "visible subject",

// Retrieve the currencies: https://github.com/fattureincloud/fattureincloud-ts-sdk/blob/master/docs/InfoApi.md#listCurrencies

currency: {

id: "EUR",

},

// Retrieve the languages: https://github.com/fattureincloud/fattureincloud-ts-sdk/blob/master/docs/InfoApi.md#listLanguages

language: {

code: "it",

name: "italiano",

},

};

As done in the previous step, we'll show you the list of the fields to be populated for this step:

| Field Name | Field Code | Value | Notes |

|---|---|---|---|

| Issued document date | data.date | 2022-01-20 | |

| Entity name | data.number | 1 | |

| Entity vat number | data.numeration | /fatt | |

| Entity tax code | data.subject | internal subject | |

| Entity address street | data.visible_subject | visible subject | |

| Currency code | data.currency.id | EUR | Check List Currencies |

| Currency exchange rate | data.currency.exchange_rate | 1.00000 | Check List Currencies |

| Currency symbol | data.currency.symbol | € | Check List Currencies |

| Language code | data.language.code | it | Check List Languages |

| Language extended name | data.language.name | Italiano | Check List Languages |

3️⃣ Step Three: E-Invoice

If you want to issue an electronic invoice the first thing to do is to set the e_invoice field to true, then the ei_data field needs to be set accordingly to your needs:

-

vat_kind: (esigibilità iva) can be one of the following:

- I => immediata

- D => differita

- S => spit payment

-

payment_method: one of the accepted payment methods

-

bank_iban: automatically to your settings default payment method if it is set bank_name: optional bank name bank

-

bank_beneficiary: set your name if different from your business name

-

original_document_type: optional field for invoice issue reason, can be ordine, contratto, convenzione

-

od_number: reference to the original document

-

od_date: original document issue date

-

cig: codice identificativo della gara

-

cup: codice unico di progetto

-

invoice_number: if document type is credit note this field is the reference to the invoice to be reversed

-

invoice_date: if document type is credit note this field is the date of the invoice to be reversed

There are also some fields to be set in the entity field:

-

e_invoice: must be set to true

-

ei_code: customer einvoice code

-

certified_email: optional customer pec

If you have to set advanced parameters you have to use the ei_raw fields.

The partial request looks like this:

// NOTE: this is a partial request, please wait before sending it

{

"data": {

"type": "invoice",

"entity": {

"id": 1,

"name": "Mario Rossi",

"vat_number": "47803200154",

"tax_code": "RSSMRA91M20B967Q",

"address_street": "Via Italia, 66",

"address_postal_code": "20900",

"address_city": "Milano",

"address_province": "MI",

"address_extra": "",

"country": "Italia"

},

"date": "2022-01-20",

"number": 1,

"numeration": "/fatt",

"subject": "internal subject",

"visible_subject": "visible subject",

"currency": {

"id": "EUR",

"exchange_rate": "1.00000",

"symbol": "€"

},

"language": {

"code": "it",

"name": "Italiano"

},

// Here we set e_invoice and ei_data

"e_invoice": true,

"ei_data": {

"payment_method": "MP05"

}

}

}

The corresponding code with our SDKs:

- C#

- Go

- Java

- JavaScript

- PHP

- Python

- Ruby

- TypeScript

- Zapier

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our C# SDK

// https://www.nuget.org/packages/It.FattureInCloud.Sdk/

Entity entity = new Entity(

id: 1,

name: "Mario Rossi",

vatNumber: "47803200154",

taxCode: "RSSMRA91M20B967Q",

addressStreet: "Via Italia, 66",

addressPostalCode: "20900",

addressCity: "Milano",

addressProvince: "MI",

country: "Italia"

);

IssuedDocument invoice = new IssuedDocument(

type: IssuedDocumentType.Invoice,

entity: entity,

date: new DateTime(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visibleSubject: "visible subject",

currency: new Currency(

id: "EUR"

),

language: new Language(

code: "it",

name: "italiano"

),

// Here we set e_invoice and ei_data

eInvoice: true,

eiData: new IssuedDocumentEiData(

paymentMethod:"MP05"

)

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Go SDK

// https://github.com/fattureincloud/fattureincloud-go-sdk

entity := *fattureincloud.NewEntity().

SetId(1).

SetName("Mario Rossi").

SetVatNumber("RSSMRA91M20B967Q").

SetTaxCode("Via Italia, 66").

SetAddressPostalCode("20900").

SetAddressProvince("MI").

SetCountry("Italia")

invoice := *fattureincloud.NewIssuedDocument().

SetEntity(entity).

SetType(fattureincloud.IssuedDocumentTypes.INVOICE).

SetDate("2022-01-20").

SetNumber(1).

SetNumeration("/fatt").

SetSubject("internal subject").

SetVisibleSubject("visible subject").

SetCurrency(*fattureincloud.NewCurrency().SetId("EUR")).

SetLanguage(*fattureincloud.NewLanguage().SetCode("it").SetName("italiano")).

// Here we set e_invoice and ei_data

SetEInvoice(true).

SetEiData(*fattureincloud.NewIssuedDocumentEiData().SetPaymentMethod("MP05"))

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Java SDK

// https://search.maven.org/artifact/it.fattureincloud/fattureincloud-java-sdk

Entity entity = new Entity()

.id(1)

.name("Mario Rossi")

.vatNumber("47803200154")

.taxCode("RSSMRA91M20B967Q")

.addressStreet("Via Italia, 66")

.addressPostalCode("20900")

.addressCity("Milano")

.addressProvince("MI")

.country("Italy");

IssuedDocument invoice = new IssuedDocument()

.type(IssuedDocumentType.INVOICE)

.entity(entity)

.date(LocalDate.of(2022, 1, 20))

.number(1)

.numeration("/fatt")

.subject("internal subject")

.visibleSubject("visible subject")

.currency(new Currency().id("EUR"))

.language(new Language()

.code("it")

.name("italiano"))

// Here we set e_invoice and ei_data

.eInvoice(true)

.eiData(

new IssuedDocumentEiData()

.paymentMethod("MP05")

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our JS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-js-sdk

let entity = new fattureInCloudSdk.Entity()

entity.id = 1

entity.name = "Mario Rossi"

entity.vat_number = "47803200154"

entity.tax_code = "RSSMRA91M20B967Q"

entity.address_street = "Via Italia, 66"

entity.address_postal_code = "20900"

entity.address_city = "Milano"

entity.address_province = "MI"

entity.country = "Italia"

let invoice = new fattureInCloudSdk.IssuedDocument()

invoice.type = new fattureInCloudSdk.IssuedDocumentType().invoice

invoice.entity = entity

invoice.date = "2022-01-20"

invoice.number = 1

invoice.numeration = "/fatt"

invoice.subject = "internal subject"

invoice.visible_subject = "visible subject"

invoice.currency = {

id: "EUR"

}

invoice.language = {

code: "it",

name: "Italiano"

}

// Here we set e_invoice and ei_data

invoice.e_invoice = true

invoice.ei_data = {

payment_method = "MP05"

}

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our PHP SDK

// https://packagist.org/packages/fattureincloud/fattureincloud-php-sdk

$entity = new Entity;

$entity

->setId(1)

->setName("Mario Rossi")

->setVatNumber("47803200154")

->setTaxCode("RSSMRA91M20B967Q")

->setAddressStreet("Via Italia, 66")

->setAddressPostalCode("20900")

->setAddressCity("Milano")

->setAddressProvince("MI")

->setCountry("Italia");

$invoice = new IssuedDocument;

$invoice->setType(IssuedDocumentType::INVOICE);

$invoice->setEntity($entity);

$invoice->setDate(new DateTime("2022-01-20"));

$invoice->setNumber(1);

$invoice->setNumeration("/fatt");

$invoice->setSubject("internal subject");

$invoice->setVisibleSubject("visible subject");

$invoice->setCurrency(

new Currency(

array(

"id" => "EUR"

)

)

);

$invoice->setLanguage(

new Language(

array(

"code" => "it",

"name" => "italiano"

)

)

);

// Here we set e_invoice and ei_data

$invoice->setEInvoice(true);

$invoice->setEiData(

new IssuedDocumentEiData(

array(

"payment_method" => "MP05"

)

)

);

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Python SDK

# https://pypi.org/project/fattureincloud-python-sdk/

entity = Entity(

id=1,

name="Mario Rossi",

vat_number="47803200154",

tax_code="RSSMRA91M20B967Q",

address_street="Via Italia, 66",

address_postal_code="20900",

address_city="Milano",

address_province="MI",

country="Italia"

)

invoice = IssuedDocument(

type = IssuedDocumentType("invoice"),

entity = entity,

date = datetime.date(2021, 1, 20),

number = 1,

numeration = "/fatt",

subject = "internal subject",

visible_subject = "visible subject",

currency = Currency(

id="EUR"

),

language = Language(

code="it",

name="italiano"

),

# Here we set e_invoice and ei_data

e_invoice = True,

ei_data = IssuedDocumentEiData(

payment_method="MP05"

)

)

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Ruby SDK

# https://rubygems.org/gems/fattureincloud_ruby_sdk

entity = FattureInCloud_Ruby_Sdk::Entity.new(

id: 1,

name: "Mario Rossi",

vat_number: "47803200154",

tax_code: "RSSMRA91M20B967Q",

address_street: "Via Italia, 66",

address_postal_code: "20900",

address_city: "Milano",

address_province: "MI",

country: "Italia"

)

invoice = FattureInCloud_Ruby_Sdk::IssuedDocument.new(

type: FattureInCloud_Ruby_Sdk::IssuedDocumentType::INVOICE,

entity: entity,

date: Date.new(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visible_subject: "visible subject",

currency: FattureInCloud_Ruby_Sdk::Currency.new(

id: "EUR"

),

language: FattureInCloud_Ruby_Sdk::Language.new(

code: "it",

name: "italiano"

),

# Here we set e_invoice and ei_data

e_invoice: true,

ei_data: FattureInCloud_Ruby_Sdk::IssuedDocumentEiData.new(

payment_method: "MP05"

)

)

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our TS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-ts-sdk

let entity: Entity = {};

entity.id = 1;

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

let invoice: IssuedDocument = {

type: IssuedDocumentType.Invoice,

entity: entity,

date: "2022-01-20",

number: 1,

numeration: "/fatt",

subject: "internal subject",

visible_subject: "visible subject",

currency: {

id: "EUR",

},

language: {

code: "it",

name: "italiano",

},

// Here we set e_invoice and ei_data

e_invoice: true,

ei_data: {

payment_method: "MP05",

},

};

As done in the previous step, we'll show you the list of the fields to be populated for this step:

| Field Name | Field Code | Value | Notes |

|---|---|---|---|

| Issued document is an e-invoice | data.e_invoice | true | |

| E-invoice payment methid | data.ei_data.payment_method | MP05 | see here for the accepted values of ModalitaPagamento |

4️⃣ Step Four: Contributions and Withholdings

The Contributions and withholdings section allows the insertion of Casse Professionali, Rivalsa, Withholding tax, and other Withholdings / Enasarco.

-

cassa professionisti: you can set up two Casse professionisti and set the fields according to your needs.

-

rivalsa (INPS): you can set up the Rivalsa and charge it to your clients setting the appropriate fields.

-

withholding tax: you can set up the Irpef withholding tax setting the appropriate fields.

-

enasarco and other withholdings: you will find also the fields to set up Enasarco and other Withholdings.

5️⃣ Step Five: Items list

The items composing the invoice are included in the Items List section.

As already seen in step one, you have three possibilities to add items:

-

If you already inserted the Product in the Fatture in Cloud API, you can retrieve it using the Products API. See also: Get a list of the products

-

If this is a new product, and you want to add it to Fatture in Cloud, you can do it now. See also: Create a new product

-

If you don't want to save this product for future use, just insert it in the request.

Our new Utilities tool also makes possible to export the current list of products, so you could use it to jumpstart your invoice creation process!

The items_list is an array of items: Just remember to specify the id if you inserted a product using the Product API and want to link it to the invoice.

If you are not familiar with the invoice item, you can find below the description of the fields:

-

code: optional, a custom code

-

name: product name

-

net_price/gross_price: price per single item, if you set the flag use_gross_prices to true you have to specify the gross_price

-

vat: the only field you have to set is the id, you can get the id of the vat you need by performing a list vat type call or create a vat type if the one you want does not exist yet.

-

discount: optional, discount percentage, automatically set if you specified the default discount in the relative client registry

-

category: useful to categorize your products

-

description: additional details

-

qty: number of products sold

-

measure: optional, unit of measure of the product (eg: kilograms, liters, days, etc...)

-

not_taxable: if this flag is set to true the amount will not be counted as revenue.

-

apply_withholding_tax: if you don't want withholding taxes, rivalsa, and cassa to be applied set this flag to false.

If you want to add a 'bollo a carico del cliente' in a einvoice, you have to add a new item, set the name to 'Bollo in fattura', net_price to 2€, not_taxable to true and the vat.id field to 21 (0% Escluso Art.15), if the invoice is not electronic it's enough to set the field stamp_duty to the amount you want to charge, keep in mind that using the stamp_duty in a einvoice the 'bollo' will be charged to you, not to the customer.

If you choose to link an existing product (or to create a new one) make sure you set all the fields you want to be shown in your invoice: at this moment we don't autocomplete your invoice with the product details, even if it is already stored in Fatture in Cloud. You can get the info about your product performing a Get Product request.

Now we add the items_list to our request:

// NOTE: this is a partial request, please wait before sending it

{

"data": {

"type": "invoice",

"entity": {

"id": 1,

"name": "Mario Rossi",

"vat_number": "47803200154",

"tax_code": "RSSMRA91M20B967Q",

"address_street": "Via Italia, 66",

"address_postal_code": "20900",

"address_city": "Milano",

"address_province": "MI",

"address_extra": "",

"country": "Italia"

},

"date": "2022-01-20",

"number": 1,

"numeration": "/fatt",

"subject": "internal subject",

"visible_subject": "visible subject",

"currency": {

"id": "EUR",

"exchange_rate": "1.00000",

"symbol": "€"

},

"language": {

"code": "it",

"name": "Italiano"

},

"items_list": [

{

"product_id": 4,

"code": "TV3",

"name": "Tavolo in legno",

"net_price": 100,

"category": "cucina",

"discount": 0,

"qty": 1,

"vat": {

"id": 0 #22%

}

}

]

}

}

The corresponding code with our SDKs:

- C#

- Go

- Java

- JavaScript

- PHP

- Python

- Ruby

- TypeScript

- Zapier

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our C# SDK

// https://www.nuget.org/packages/It.FattureInCloud.Sdk/

Entity entity = new Entity(

id: 1,

name: "Mario Rossi",

vatNumber: "47803200154",

taxCode: "RSSMRA91M20B967Q",

addressStreet: "Via Italia, 66",

addressPostalCode: "20900",

addressCity: "Milano",

addressProvince: "MI",

country: "Italia"

);

IssuedDocument invoice = new IssuedDocument(

type: IssuedDocumentType.Invoice,

entity: entity,

date: new DateTime(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visibleSubject: "visible subject",

currency: new Currency(

id: "EUR"

),

language: new Language(

code: "it",

name: "italiano"

),

// Here we set the Items List

// List your products: https://github.com/fattureincloud/fattureincloud-csharp-sdk/blob/master/docs/ProductsApi.md#listProducts

itemsList: new List < IssuedDocumentItemsListItem > {

new IssuedDocumentItemsListItem(

productId: 4,

code: "TV3",

name: "Tavolo in legno",

netPrice: 100,

category: "cucina",

discount: 0,

qty: 1,

vat: new VatType(

id: 0

)

)

}

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Go SDK

// https://github.com/fattureincloud/fattureincloud-go-sdk

entity := *fattureincloud.NewEntity().

SetId(1).

SetName("Mario Rossi").

SetVatNumber("RSSMRA91M20B967Q").

SetTaxCode("RSSMRA91M20B967Q").

SetAddressStreet("Via Italia, 66").

SetAddressPostalCode("20900").

SetAddressCity("Milano").

SetAddressProvince("MI").

SetCountry("Italia")

invoice := *fattureincloud.NewIssuedDocument().

SetEntity(entity).

SetType(fattureincloud.IssuedDocumentTypes.INVOICE).

SetDate("2022-01-20").

SetNumber(1).

SetNumeration("/fatt").

SetSubject("internal subject").

SetVisibleSubject("visible subject").

SetCurrency(*fattureincloud.NewCurrency().SetId("EUR")).

SetLanguage(*fattureincloud.NewLanguage().SetCode("it").SetName("italiano")).

// Here we set the Items List

// List your products: https://github.com/fattureincloud/fattureincloud-go-sdk/blob/master/docs/ProductsApi.md#listProducts

SetItemsList([]fattureincloud.IssuedDocumentItemsListItem{

*fattureincloud.NewIssuedDocumentItemsListItem().

SetProductId(4).

SetCode("TV3").

SetName("Tavolo in legno").

SetNetPrice(100).

SetCategory("cucina").

SetDiscount(0).

SetQty(1).

SetVat(*fattureincloud.NewVatType().SetId(0)),

})

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Java SDK

// https://search.maven.org/artifact/it.fattureincloud/fattureincloud-java-sdk

Entity entity = new Entity()

.id(1)

.name("Mario Rossi")

.vatNumber("47803200154")

.taxCode("RSSMRA91M20B967Q")

.addressStreet("Via Italia, 66")

.addressPostalCode("20900")

.addressCity("Milano")

.addressProvince("MI")

.country("Italy");

IssuedDocument invoice = new IssuedDocument()

.type(IssuedDocumentType.INVOICE)

.entity(entity)

.date(LocalDate.of(2022, 1, 20))

.number(1)

.numeration("/fatt")

.subject("internal subject")

.visibleSubject("visible subject")

.currency(new Currency().id("EUR"))

.language(new Language()

.code("it")

.name("italiano")

)

// Here we set the Items List

// List your products: https://github.com/fattureincloud/fattureincloud-java-sdk/blob/master/docs/ProductsApi.md#listProducts

.addItemsListItem(

new IssuedDocumentItemsListItem()

.productId(4)

.code("TV3")

.name("Tavolo in legno")

.netPrice(BigDecimal.valueOf(100))

.category("cucina")

.discount(BigDecimal.valueOf(0))

.qty(BigDecimal.valueOf(1))

.vat(new VatType().id(0))

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our JS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-js-sdk

let entity = new fattureInCloudSdk.Entity();

entity.id = 1;

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

let invoice = new fattureInCloudSdk.IssuedDocument();

invoice.type = new fattureInCloudSdk.IssuedDocumentType().invoice;

invoice.entity = entity;

invoice.date = "2022-01-20";

invoice.number = 1;

invoice.numeration = "/fatt";

invoice.subject = "internal subject";

invoice.visible_subject = "visible subject";

invoice.currency = {

id: "EUR",

};

invoice.language = {

code: "it",

name: "Italiano",

};

// Here we set the Items List

// List your products: https://github.com/fattureincloud/fattureincloud-js-sdk/blob/master/docs/ProductsApi.md#listProducts

invoice.items_list = [

{

product_id: 4,

code: "tv3",

name: "tavolo in legno",

net_price: 100,

category: "cucina",

discount: 0,

qty: 1,

vat: {

id: 0,

},

},

];

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our PHP SDK

// https://packagist.org/packages/fattureincloud/fattureincloud-php-sdk

$entity = new Entity;

$entity

->setId(1)

->setName("Mario Rossi")

->setVatNumber("47803200154")

->setTaxCode("RSSMRA91M20B967Q")

->setAddressStreet("Via Italia, 66")

->setAddressPostalCode("20900")

->setAddressCity("Milano")

->setAddressProvince("MI")

->setCountry("Italia");

$invoice = new IssuedDocument;

$invoice->setType(IssuedDocumentType::INVOICE);

$invoice->setEntity($entity);

$invoice->setDate(new DateTime("2022-01-20"));

$invoice->setNumber(1);

$invoice->setNumeration("/fatt");

$invoice->setSubject("internal subject");

$invoice->setVisibleSubject("visible subject");

$invoice->setCurrency(

new Currency(

array(

"id" => "EUR"

)

)

);

$invoice->setLanguage(

new Language(

array(

"code" => "it",

"name" => "italiano"

)

)

);

// Here we set the Items List

// List your products: https://github.com/fattureincloud/fattureincloud-php-sdk/blob/master/docs/Api/ProductsApi.md#listproducts

$invoice->setItemsList(

array(

new IssuedDocumentItemsListItem(

array(

"product_id" => 4,

"code" => "TV3",

"name" => "Tavolo in legno",

"net_price" => 100,

"category" => "cucina",

"discount" => 0,

"qty" => 1,

"vat" => new VatType(

array(

"id" => 0

)

)

)

)

)

);

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Python SDK

# https://pypi.org/project/fattureincloud-python-sdk/

entity = Entity(

id=1,

name="Mario Rossi",

vat_number="47803200154",

tax_code="RSSMRA91M20B967Q",

address_street="Via Italia, 66",

address_postal_code="20900",

address_city="Milano",

address_province="MI",

country="Italia"

)

invoice = IssuedDocument(

type = IssuedDocumentType("invoice"),

entity = entity,

date = datetime.date(2021, 1, 20),

number = 1,

numeration = "/fatt",

subject = "internal subject",

visible_subject = "visible subject",

currency = Currency(

id="EUR"

),

language = Language(

code="it",

name="italiano"

),

# Here we set the Items List

# List your products: https://github.com/fattureincloud/fattureincloud-python-sdk/blob/master/docs/ProductsApi.md#list_products

items_list = [

IssuedDocumentItemsListItem(

product_id=4,

code="TV3",

name="Tavolo in legno",

net_price=100.0,

category="cucina",

discount=0.0,

qty=1.0,

vat=VatType(

id=0

)

)

]

)

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Ruby SDK

# https://rubygems.org/gems/fattureincloud_ruby_sdk

entity = FattureInCloud_Ruby_Sdk::Entity.new(

id: 1,

name: "Mario Rossi",

vat_number: "47803200154",

tax_code: "RSSMRA91M20B967Q",

address_street: "Via Italia, 66",

address_postal_code: "20900",

address_city: "Milano",

address_province: "MI",

country: "Italia",

)

invoice = FattureInCloud_Ruby_Sdk::IssuedDocument.new(

type: FattureInCloud_Ruby_Sdk::IssuedDocumentType::INVOICE,

entity: entity,

date: Date.new(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visible_subject: "visible subject",

currency: FattureInCloud_Ruby_Sdk::Currency.new(

id: "EUR"

),

language: FattureInCloud_Ruby_Sdk::Language.new(

code: "it",

name: "italiano"

),

# Here we set the Items List

# List your products: https://github.com/fattureincloud/fattureincloud-ruby-sdk/blob/master/docs/ProductsApi.md#list_products

items_list: Array(

FattureInCloud_Ruby_Sdk::IssuedDocumentItemsListItem.new(

product_id: 4,

code: "TV3",

name: "Tavolo in legno",

net_price: 100,

category: "cucina",

discount: 0,

qty: 1,

vat: FattureInCloud_Ruby_Sdk::VatType.new(

id: 0

)

)

)

)

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our TS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-ts-sdk

let entity: Entity = {};

entity.id = 1;

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

let invoice: IssuedDocument = {

type: IssuedDocumentType.Invoice,

entity: entity,

date: "2022-01-20",

number: 1,

numeration: "/fatt",

subject: "internal subject",

visible_subject: "visible subject",

currency: {

id: "EUR",

},

language: {

code: "it",

name: "italiano",

},

// Here we set the Items List

// List your products: https://github.com/fattureincloud/fattureincloud-ts-sdk/blob/master/docs/ProductsApi.md#listProducts

items_list: [

{

product_id: 4,

code: "TV3",

name: "Tavolo in legno",

net_price: 100,

category: "cucina",

discount: 0,

qty: 1,

vat: {

id: 0,

},

},

],

};

The Items List in fact accepts an array of items.

In this example, we'll insert only a single item, but you can check how to insert multiple items in the Zapier Documentation.

As done in the previous step, we'll show you the list of the fields to be populated for this step:

| Field Name | Field Code | Value | Notes |

|---|---|---|---|

| Data.items list - Issued document item product id | data.items_list.product_id | 4 | Check List Products |

| Data.items list - Issued document item product code | data.items_list.code | TV3 | |

| Data.items list - Issued document item product name | data.items_list.name | Tavolo in legno | |

| Data.items list - Issued document item product net price | data.items_list.net_price | 100 | |

| Data.items list - Issued document item product category | data.items_list.category | cucina | |

| Data.items list - Issued document item product description | data.items_list.discount | 0 | |

| Data.items list - Issued document item product qty | data.items_list.qty | 1 | |

| Data.items list - Vat type id | data.items_list.vat.id | 0 | Check List VAT Type |

6️⃣ Step Six: Payments List

The Payment List section allows the insertion of all the info about your invoice payments.

-

amount: the amount of the payment.

-

payment_terms: the number of days by which the payment must be made can be set.

-

due_date: the date by which the payment must be made.

-

status: the payment status, can be not_paid, paid, and reversed.

-

payment_account: if the status of the invoice is paid, the payment account id needs to be set, make sure it exists or you will get an error. You can get a list of your payment accounts or create a new one as you need.

Our new Utilities tool also makes possible to export the current list of payment accounts, so you could use it to jumpstart your invoice creation process!

Here we suppose that the status is "paid", and we add the new parameters to the request:

// NOTE: this is a partial request, please wait before sending it

{

"data": {

"type": "invoice",

"entity": {

"id": 1,

"name": "Mario Rossi",

"vat_number": "47803200154",

"tax_code": "RSSMRA91M20B967Q",

"address_street": "Via Italia, 66",

"address_postal_code": "20900",

"address_city": "Milano",

"address_province": "MI",

"address_extra": "",

"country": "Italia"

},

"date": "2022-01-20",

"number": 1,

"numeration": "/fatt",

"subject": "internal subject",

"visible_subject": "visible subject",

"currency": {

"id": "EUR",

"exchange_rate": "1.00000",

"symbol": "€"

},

"language": {

"code": "it",

"name": "Italiano"

},

"items_list": [

{

"product_id": 4,

"code": "TV3",

"name": "Tavolo in legno",

"net_price": 100,

"category": "cucina",

"discount": 0,

"qty": 1,

"vat": {

"id": 0

}

}

],

"payments_list": [

{

"amount": 122,

"due_date": "2022-01-23",

"paid_date": "2022-01-22",

"status": "paid",

"payment_account": {

"id": 110

}

}

]

}

}

The corresponding code with our SDKs:

- C#

- Go

- Java

- JavaScript

- PHP

- Python

- Ruby

- TypeScript

- Zapier

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our C# SDK

// https://www.nuget.org/packages/It.FattureInCloud.Sdk/

Entity entity = new Entity(

id: 1,

name: "Mario Rossi",

vatNumber: "47803200154",

taxCode: "RSSMRA91M20B967Q",

addressStreet: "Via Italia, 66",

addressPostalCode: "20900",

addressCity: "Milano",

addressProvince: "MI",

country: "Italia"

);

IssuedDocument invoice = new IssuedDocument(

type: IssuedDocumentType.Invoice,

entity: entity,

date: new DateTime(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visibleSubject: "visible subject",

currency: new Currency(

id: "EUR"

),

language: new Language(

code: "it",

name: "italiano"

),

itemsList: new List < IssuedDocumentItemsListItem > {

new IssuedDocumentItemsListItem(

productId: 4,

code: "TV3",

name: "Tavolo in legno",

netPrice: 100,

category: "cucina",

discount: 0,

qty: 1,

vat: new VatType(

id: 0

)

)

},

// Here we set the payments list assuming our invoice has already been paid

paymentsList: new List < IssuedDocumentPaymentsListItem > {

new IssuedDocumentPaymentsListItem(

amount: 122,

dueDate: new DateTime(2022, 01, 23),

paidDate: new DateTime(2022, 01, 22),

status: IssuedDocumentStatus.Paid,

// List your payment accounts: https://github.com/fattureincloud/fattureincloud-csharp-sdk/blob/master/docs/InfoApi.md#listPaymentAccounts

paymentAccount: new PaymentAccount(

id: 110

)

)

}

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Go SDK

// https://github.com/fattureincloud/fattureincloud-go-sdk

entity := *fattureincloud.NewEntity().

SetId(1).

SetName("Mario Rossi").

SetVatNumber("RSSMRA91M20B967Q").

SetTaxCode("RSSMRA91M20B967Q").

SetAddressStreet("Via Italia, 66").

SetAddressPostalCode("20900").

SetAddressCity("Milano").

SetAddressProvince("MI").

SetCountry("Italia")

invoice := *fattureincloud.NewIssuedDocument().

SetEntity(entity).

SetType(fattureincloud.IssuedDocumentTypes.INVOICE).

SetDate("2022-01-20").

SetNumber(1).

SetNumeration("/fatt").

SetSubject("internal subject").

SetVisibleSubject("visible subject").

SetCurrency(*fattureincloud.NewCurrency().SetId("EUR")).

SetLanguage(*fattureincloud.NewLanguage().SetCode("it").SetName("italiano")).

SetItemsList([]fattureincloud.IssuedDocumentItemsListItem{

*fattureincloud.NewIssuedDocumentItemsListItem().

SetProductId(4).

SetCode("TV3").

SetName("Tavolo in legno").

SetNetPrice(100).

SetCategory("cucina").

SetDiscount(0).

SetQty(1).

SetVat(*fattureincloud.NewVatType().SetId(0)),

}).

// Here we set the Payments List

// List your payment accounts: https://github.com/fattureincloud/fattureincloud-ts-sdk/blob/master/docs/InfoApi.md#listPaymentAccounts

SetPaymentsList([]fattureincloud.IssuedDocumentPaymentsListItem{

*fattureincloud.NewIssuedDocumentPaymentsListItem().

SetAmount(122).

SetDueDate("2022-01-23").

SetPaidDate("2022-01-22").

SetStatus(fattureincloud.IssuedDocumentStatuses.NOT_PAID).

SetPaymentAccount(*fattureincloud.NewPaymentAccount().SetId(110)),

})

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our Java SDK

// https://search.maven.org/artifact/it.fattureincloud/fattureincloud-java-sdk

Entity entity = new Entity()

.id(1)

.name("Mario Rossi")

.vatNumber("47803200154")

.taxCode("RSSMRA91M20B967Q")

.addressStreet("Via Italia, 66")

.addressPostalCode("20900")

.addressCity("Milano")

.addressProvince("MI")

.country("Italy");

IssuedDocument invoice = new IssuedDocument()

.type(IssuedDocumentType.INVOICE)

.entity(entity)

.date(LocalDate.of(2022, 1, 20))

.number(1)

.numeration("/fatt")

.subject("internal subject")

.visibleSubject("visible subject")

.currency(new Currency().id("EUR"))

.language(new Language()

.code("it")

.name("italiano")

)

.addItemsListItem(

new IssuedDocumentItemsListItem()

.productId(4)

.code("TV3")

.name("Tavolo in legno")

.netPrice(BigDecimal.valueOf(100))

.category("cucina")

.discount(BigDecimal.valueOf(0))

.qty(BigDecimal.valueOf(1))

.vat(new VatType().id(0))

)

// Here we set the payments list assuming our invoice has already been paid

.addPaymentsListItem(

new IssuedDocumentPaymentsListItem()

.amount(BigDecimal.valueOf(122))

.dueDate(LocalDate.of(2022, 01, 23))

.paidDate(LocalDate.of(2022, 01, 22))

.status(IssuedDocumentStatus.PAID)

// List your payment accounts: https://github.com/fattureincloud/fattureincloud-java-sdk/blob/master/docs/InfoApi.md#listPaymentAccounts

.paymentAccount(new PaymentAccount().id(110))

);

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our JS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-js-sdk

let entity = new fattureInCloudSdk.Entity();

entity.id = 1;

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

let invoice = new fattureInCloudSdk.IssuedDocument();

invoice.type = new fattureInCloudSdk.IssuedDocumentType().invoice;

invoice.entity = entity;

invoice.date = "2022-01-20";

invoice.number = 1;

invoice.numeration = "/fatt";

invoice.subject = "internal subject";

invoice.visible_subject = "visible subject";

invoice.currency = {

id: "EUR",

};

invoice.language = {

code: "it",

name: "Italiano",

};

invoice.items_list = [

{

product_id: 4,

code: "tv3",

name: "tavolo in legno",

net_price: 100,

category: "cucina",

discount: 0,

qty: 1,

vat: {

id: 0,

},

},

];

// Here we set the payments list assuming our invoice has already been paid

invoice.payments_list = [

{

amount: 122,

due_date: "2022-01-23",

paid_date: "2022-01-22",

status: "paid",

// List your payment accounts: https://github.com/fattureincloud/fattureincloud-js-sdk/blob/master/docs/InfoApi.md#listPaymentAccounts

payment_account: {

id: 10,

},

},

];

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our PHP SDK

// https://packagist.org/packages/fattureincloud/fattureincloud-php-sdk

$entity = new Entity;

$entity

->setId(1)

->setName("Mario Rossi")

->setVatNumber("47803200154")

->setTaxCode("RSSMRA91M20B967Q")

->setAddressStreet("Via Italia, 66")

->setAddressPostalCode("20900")

->setAddressCity("Milano")

->setAddressProvince("MI")

->setCountry("Italia");

$invoice = new IssuedDocument;

$invoice->setType(IssuedDocumentType::INVOICE);

$invoice->setEntity($entity);

$invoice->setDate(new DateTime("2022-01-20"));

$invoice->setNumber(1);

$invoice->setNumeration("/fatt");

$invoice->setSubject("internal subject");

$invoice->setVisibleSubject("visible subject");

$invoice->setCurrency(

new Currency(

array(

"id" => "EUR"

)

)

);

$invoice->setLanguage(

new Language(

array(

"code" => "it",

"name" => "italiano"

)

)

);

$invoice->setItemsList(

array(

new IssuedDocumentItemsListItem(

array(

"product_id" => 4,

"code" => "TV3",

"name" => "Tavolo in legno",

"net_price" => 100,

"category" => "cucina",

"discount" => 0,

"qty" => 1,

"vat" => new VatType(

array(

"id" => 0

)

)

)

)

)

);

// Here we set the payments list assuming our invoice has already been paid

$invoice->setPaymentsList(

array(

new IssuedDocumentPaymentsListItem(

array(

"amount" => 122,

"due_date" => new DateTime("2022-01-23"),

"paid_date" => new DateTime("2022-01-22"),

"status" => IssuedDocumentStatus::PAID,

// List your payment accounts: https://github.com/fattureincloud/fattureincloud-php-sdk/blob/master/docs/Api/InfoApi.md#listpaymentaccounts

"payment_account" => new PaymentAccount(

array(

"id" => 110

)

)

)

)

)

);

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Python SDK

# https://pypi.org/project/fattureincloud-python-sdk/

entity = Entity(

id=1,

name="Mario Rossi",

vat_number="47803200154",

tax_code="RSSMRA91M20B967Q",

address_street="Via Italia, 66",

address_postal_code="20900",

address_city="Milano",

address_province="MI",

country="Italia"

)

invoice = IssuedDocument(

type = IssuedDocumentType("invoice"),

entity = entity,

date = datetime.date(2021, 1, 20),

number = 1,

numeration = "/fatt",

subject = "internal subject",

visible_subject = "visible subject",

currency = Currency(

id="EUR"

),

language = Language(

code="it",

name="italiano"

),

items_list = [

IssuedDocumentItemsListItem(

product_id=4,

code="TV3",

name="Tavolo in legno",

net_price=100.0,

category="cucina",

discount=0.0,

qty=1.0,

vat=VatType(

id=0

)

)

],

# Here we set the payments list assuming our invoice has already been paid

payments_list = [

IssuedDocumentPaymentsListItem(

amount=122.0,

due_date=datetime.date(2022, 1, 23),

paid_date=datetime.date(2022, 1, 22),

status=IssuedDocumentStatus("paid"),

# List your payment accounts: https://github.com/fattureincloud/fattureincloud-python-sdk/blob/master/docs/InfoApi.md#list_payment_accounts

payment_account=PaymentAccount(

id=110

)

)

]

)

# NOTE: this is a partial request, please wait before sending it

# in this example we are using our Ruby SDK

# https://rubygems.org/gems/fattureincloud_ruby_sdk

entity = FattureInCloud_Ruby_Sdk::Entity.new(

id: 1,

name: "Mario Rossi",

vat_number: "47803200154",

tax_code: "RSSMRA91M20B967Q",

address_street: "Via Italia, 66",

address_postal_code: "20900",

address_city: "Milano",

address_province: "MI",

country: "Italia",

)

invoice = FattureInCloud_Ruby_Sdk::IssuedDocument.new(

type: FattureInCloud_Ruby_Sdk::IssuedDocumentType::INVOICE,

entity: entity,

date: Date.new(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visible_subject: "visible subject",

currency: FattureInCloud_Ruby_Sdk::Currency.new(

id: "EUR"

),

language: FattureInCloud_Ruby_Sdk::Language.new(

code: "it",

name: "italiano"

),

items_list: Array(

FattureInCloud_Ruby_Sdk::IssuedDocumentItemsListItem.new(

product_id: 4,

code: "TV3",

name: "Tavolo in legno",

net_price: 100,

category: "cucina",

discount: 0,

qty: 1,

vat: FattureInCloud_Ruby_Sdk::VatType.new(

id: 0

)

)

),

# Here we set the payments list assuming our invoice has already been paid

payments_list: Array(

FattureInCloud_Ruby_Sdk::IssuedDocumentPaymentsListItem.new(

amount: 122,

due_date: Date.new(2022, 01, 23),

paid_date: Date.new(2022, 01, 22),

status: FattureInCloud_Ruby_Sdk::IssuedDocumentStatus::PAID,

# List your payment accounts: https://github.com/fattureincloud/fattureincloud-ruby-sdk/blob/master/docs/InfoApi.md#list_payment_accounts

payment_account: FattureInCloud_Ruby_Sdk::PaymentAccount.new(

id: 110

)

)

)

)

// NOTE: this is a partial request, please wait before sending it

// in this example we are using our TS SDK

// https://www.npmjs.com/package/@fattureincloud/fattureincloud-ts-sdk

let entity: Entity = {};

entity.id = 1;

entity.name = "Mario Rossi";

entity.vat_number = "47803200154";

entity.tax_code = "RSSMRA91M20B967Q";

entity.address_street = "Via Italia, 66";

entity.address_postal_code = "20900";

entity.address_city = "Milano";

entity.address_province = "MI";

entity.country = "Italia";

let invoice: IssuedDocument = {

type: IssuedDocumentType.Invoice,

entity: entity,

date: "2022-01-20",

number: 1,

numeration: "/fatt",

subject: "internal subject",

visible_subject: "visible subject",

currency: {

id: "EUR",

},

language: {

code: "it",

name: "italiano",

},

items_list: [

{

product_id: 4,

code: "TV3",

name: "Tavolo in legno",

net_price: 100,

category: "cucina",

discount: 0,

qty: 1,

vat: {

id: 0,

},

},

],

// Here we set the payments list assuming our invoice has already been paid

payments_list: [

{

amount: 122,

due_date: "2022-01-23",

paid_date: "2022-01-22",

status: "paid",

// List your payment accounts: https://github.com/fattureincloud/fattureincloud-ts-sdk/blob/master/docs/InfoApi.md#listPaymentAccounts

payment_account: {

id: 10,

},

},

],

};

The Payments List in fact accepts an array of items.

In this example, we'll insert only a single item, but you can check how to insert multiple items in the Zapier Documentation.

As done in the previous step, we'll show you the list of the fields to be populated for this step:

| Field Name | Field Code | Value | Notes |

|---|---|---|---|

| Data.payments list - Issued document payment amount | data.payments_list.amount | 122 | |

| Data.payments list - Issued document payment due date | data.payments_list.due_date | 2022-01-23 | |

| Data.payments list - Issued document payment date | data.payments_list.paid_date | 2022-01-22 | |

| Data.payments list - Issued document status | data.payments_list.status | paid | |

| Data.payments list - Payment account id | data.payments_list.payment_account.id | 110 | Check List Payment Accounts |

If you want to know more about the calculation of the amounts you can visit the calculating totals page.

7️⃣ Step Seven: Advanced Options

The Advanced Options section allows the management of the payment methods and the direct generation of DDT and accompanying invoices.

-

payment_method: you can use this field to communicate to the customer how to pay the invoice; the only required parameter is the payment method id, make sure it exists or you will get an error. You can get a list of your payment methods or create a new one according to your needs.

-

show_payment_method: if this flag is set to true, it shows the payment method details in the invoice.

-

delivery_note: if this flag is set to true, you can set all the delivery note-related parameters and a DDT will be automatically created.

-

accompanying_invoice: if this flag is set to true, you can set all the accompanying invoice-related parameters and it will be automatically created.

-

amount_due_discount: with this parameter you can set a discount or surcharge on the total of the invoice.

-

use_split_payment: this flag can be set to true if the split payment is needed.

Our new Utilities tool also makes possible to export the current list of payment methods, so you could use it to jumpstart your invoice creation process!

Below we add the Payment Method to the request:

// NOTE: this is a partial request, please wait before sending it

{

"data": {

"type": "invoice",

"entity": {

"id": 1,

"name": "Mario Rossi",

"vat_number": "47803200154",

"tax_code": "RSSMRA91M20B967Q",

"address_street": "Via Italia, 66",

"address_postal_code": "20900",

"address_city": "Milano",

"address_province": "MI",

"address_extra": "",

"country": "Italia"

},

"date": "2022-01-20",

"number": 1,

"numeration": "/fatt",

"subject": "internal subject",

"visible_subject": "visible subject",

"currency": {

"id": "EUR",

"exchange_rate": "1.00000",

"symbol": "€"

},

"language": {

"code": "it",

"name": "Italiano"

},

"items_list": [

{

"product_id": 4,

"code": "TV3",

"name": "Tavolo in legno",

"net_price": 100,

"category": "cucina",

"discount": 0,

"qty": 1,

"vat": {

"id": 0

}

}

],

"payments_list": [

{

"amount": 122,

"due_date": "2022-01-23",

"paid_date": "2022-01-22",

"status": "paid",

"payment_account": {

"id": 110

}

}

],

"payment_method": {

"id": 386683

}

}

}

The corresponding code with our SDKs:

- C#

- Go

- Java

- JavaScript

- PHP

- Python

- Ruby

- TypeScript

- Zapier

Entity entity = new Entity(

id: 1,

name: "Mario Rossi",

vatNumber: "47803200154",

taxCode: "RSSMRA91M20B967Q",

addressStreet: "Via Italia, 66",

addressPostalCode: "20900",

addressCity: "Milano",

addressProvince: "MI",

country: "Italia"

);

IssuedDocument invoice = new IssuedDocument(

type: IssuedDocumentType.Invoice,

entity: entity,

date: new DateTime(2022, 01, 20),

number: 1,

numeration: "/fatt",

subject: "internal subject",

visibleSubject: "visible subject",

currency: new Currency(

id: "EUR"

),

language: new Language(